A crisis is always a source of stress for any business. Even when everything is going smoothly, a sudden downturn can jeopardize even the most stable companies.

— But is it possible to prepare for shocks and keep your business afloat?

— Yes!

Today we will explore a proven strategy through the example of a clothing store that survived a crisis and uncovered new opportunities.

— But is it possible to prepare for shocks and keep your business afloat?

— Yes!

Today we will explore a proven strategy through the example of a clothing store that survived a crisis and uncovered new opportunities.

Step 1. Create a crisis management team

When the situation becomes unstable, it’s crucial not to isolate yourself or try to handle every challenge alone. The first step is to establish a crisis management team – a group of reliable and skilled employees who are ready to make swift decisions and implement changes. This team will act as the “command center,” enabling a quick response, developing anti-crisis measures, and coordinating all actions to save the business.

It is important that the team includes people with diverse skill sets: managers, financial experts, marketers, and operations staff. Such synergy will help address all key aspects of the company’s operations.

Hold short daily meetings to assess the situation and adjust the action plan. All decisions should be documented with clear deadlines for execution.

It is important that the team includes people with diverse skill sets: managers, financial experts, marketers, and operations staff. Such synergy will help address all key aspects of the company’s operations.

Hold short daily meetings to assess the situation and adjust the action plan. All decisions should be documented with clear deadlines for execution.

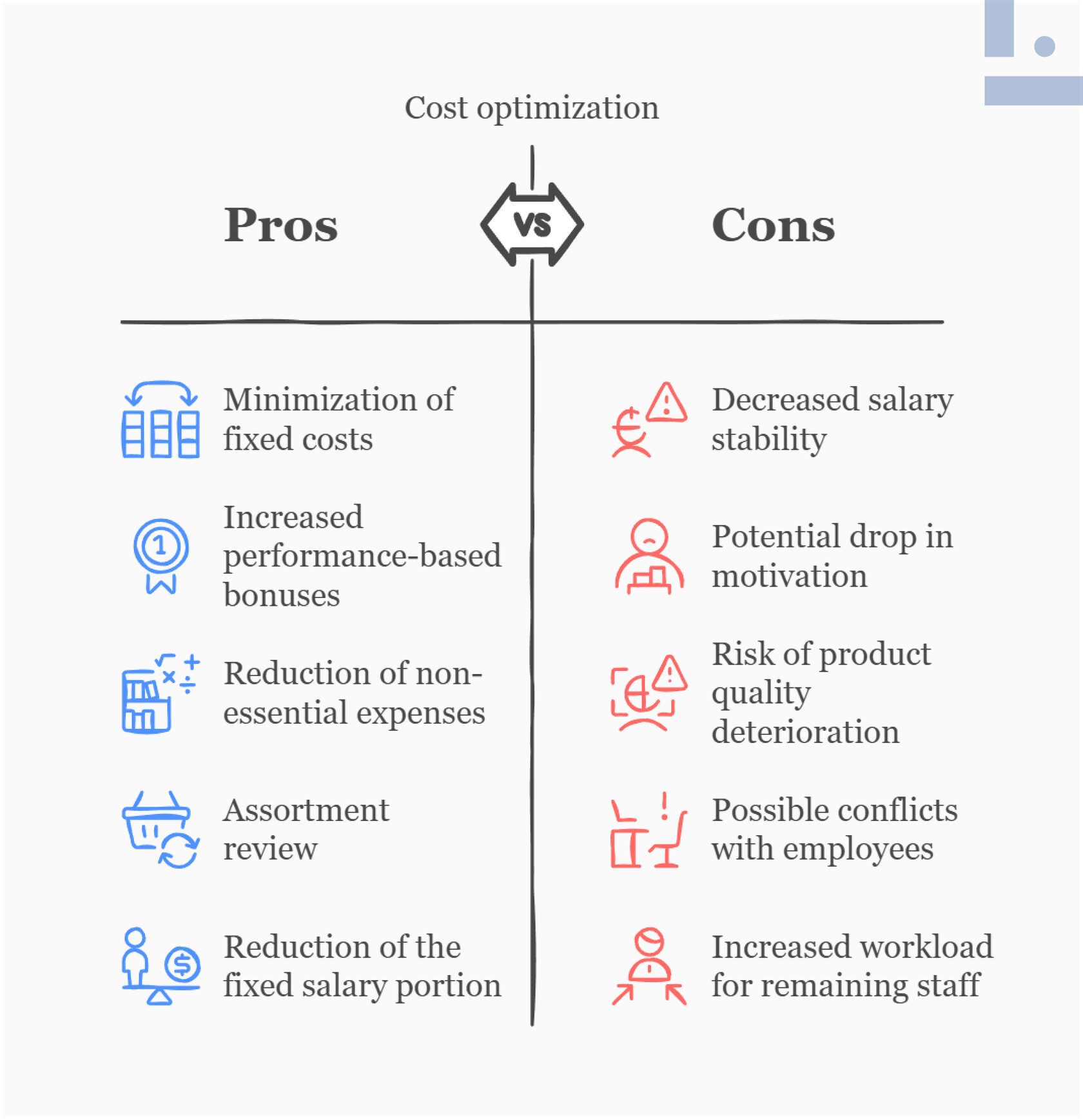

Step 2. Optimize expenses and review your cost structure

Break down all company expenses into essential and non-essential categories that can be reduced or temporarily suspended. Fixed costs – such as rent, payroll, and utilities – require immediate analysis and potential reallocation.

- Negotiate with your landlord for possible rent deferrals or reductions.

- Hold discussions with suppliers to explore discounts or changes to payment schedules.

- Review payroll – introduce a temporary bonus system for achieving key tasks and optimize staffing levels.

- Conduct a thorough assortment audit: remove low-margin or slow-moving products and adjust purchasing policies in favor of fast-selling items.

- Optimize logistics and storage processes to minimize warehousing and delivery costs.

Step 3. Organize your finances and payment schedule

Collect data on all receivables and set deadlines for debt recovery. Categorize debtors into groups: large, medium, and small clients. Actively engage with clients – prepare personalized offers, negotiate partial payments, and offer discounts for early settlements.

Develop a detailed payment schedule for creditors, clearly defining deadlines and payment priorities: rent, key suppliers, taxes, and other essential expenses.

If it is impossible to settle some debts on time, negotiate restructuring, deadline extensions, or partial payment agreements.

Develop a detailed payment schedule for creditors, clearly defining deadlines and payment priorities: rent, key suppliers, taxes, and other essential expenses.

If it is impossible to settle some debts on time, negotiate restructuring, deadline extensions, or partial payment agreements.

We offer financial consulting services to help optimize costs and strengthen your company’s financial resilience.

Step 4. Find alternative sources of income

A crisis is not just a challenge but also an opportunity. For example, a clothing store could launch online sales of its own line of homewear and accessories to create an additional revenue stream.

In this case, the decision was made to launch an online store focused on comfortable and affordable homewear as well as stylish accessories – from scarves and hats to functional backpacks. Online sales attracted a new audience beyond the usual region and partially compensated for the drop in offline sales.

You can also explore selling gift cards, participating in joint promotions with other brands, or developing customized products.

In this case, the decision was made to launch an online store focused on comfortable and affordable homewear as well as stylish accessories – from scarves and hats to functional backpacks. Online sales attracted a new audience beyond the usual region and partially compensated for the drop in offline sales.

You can also explore selling gift cards, participating in joint promotions with other brands, or developing customized products.

Step 5. Attract an investor or strategic partner

During the business recovery phase, finding additional resources is especially important. Attracting an investor can provide financial support and access to new expertise, as well as help establish partnerships with major platforms and suppliers.

A partner can contribute not only financially but also through consulting, cross-promo* opportunities, and access to new distribution channels. Consider potential investors among suppliers, logistics companies, or local retail networks.

Define specific partnership goals – entering new markets, launching joint promotions, or collaborating on production.

A partner can contribute not only financially but also through consulting, cross-promo* opportunities, and access to new distribution channels. Consider potential investors among suppliers, logistics companies, or local retail networks.

Define specific partnership goals – entering new markets, launching joint promotions, or collaborating on production.

*Cross-promo is a joint marketing campaign between two or more companies that promote each other’s products or services to achieve mutual benefits and expand their audiences.

Step 6. Explore new markets and sales channels

Shifting focus to new markets is a key element of an anti-crisis strategy. Products that perform well locally may also be in demand internationally.

For example, the clothing store’s accessory collection resonated with customers abroad, enabling entry into international marketplaces and expansion of the client base. Conduct research on new target markets while considering local cultural specifics and consumer preferences.

For example, the clothing store’s accessory collection resonated with customers abroad, enabling entry into international marketplaces and expansion of the client base. Conduct research on new target markets while considering local cultural specifics and consumer preferences.

Step 7. Revise your marketing strategy and value proposition

A crisis reshapes customer priorities. While premium quality and following trends may have been key factors previously, practicality, comfort, and affordability now take center stage.

Analyze your target audience’s needs and adapt your marketing strategy accordingly. Reframe your positioning to emphasize affordability, versatility, and product durability. Enhance your communication with promotions, free delivery, or loyalty programs.

Don’t forget to review your communication channels! Use email marketing, social media, and targeted advertising more actively to attract a new audience

Analyze your target audience’s needs and adapt your marketing strategy accordingly. Reframe your positioning to emphasize affordability, versatility, and product durability. Enhance your communication with promotions, free delivery, or loyalty programs.

Don’t forget to review your communication channels! Use email marketing, social media, and targeted advertising more actively to attract a new audience

Conclusion

Running a business is a path toward freedom and independence, but achieving resilience requires flexibility and a willingness to adapt continuously. By applying these steps and adjusting your strategy to new realities, your company can successfully navigate a crisis period and discover new growth opportunities.

Ongoing situation analysis, an engaged team, and the courage to experiment are the key ingredients of a resilient business in any environment.

Ongoing situation analysis, an engaged team, and the courage to experiment are the key ingredients of a resilient business in any environment.

Our experts provide a full range of financial services: from accounting and tax consulting to business analysis and HR support.

Would you like to strengthen your business and move forward with confidence? Contact us for a consultation – we will help you find an effective solution tailored to your company.